This is part 2 of our 3 part series on office condos. Click to Read Part 1: 5 Reasons to Reconsider the Office Condo Market

OK, I admit it, But I just couldn’t resist going with this title. With interst rates remaining historically low, property values still below peak levels and consumer confidence on the rise, business owners are asking once again:

Is owning my space right for my business ?

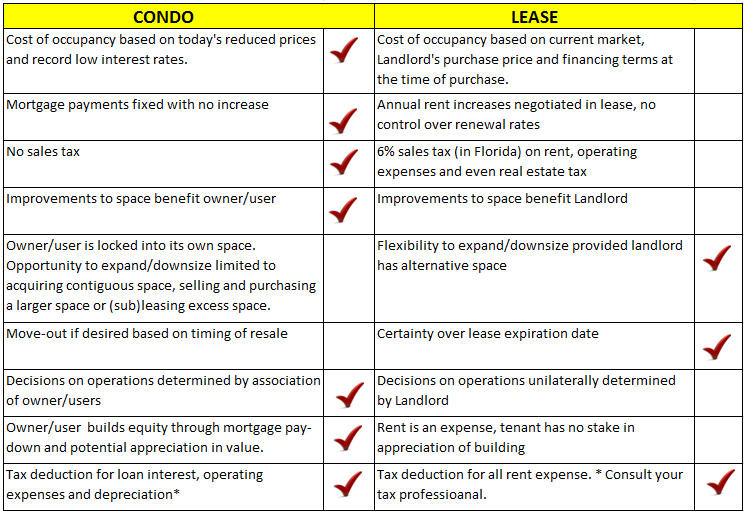

It should be noted that this comparison holds true for commercial condos as well as owner occupied buildings. It’s really not a simple answer. It involves an analysis of the business, the owner and the market. There are benefits to owning as well as leasing. It is ultimately your decision as to what is right for you. Making the right decision involves weighing the pluses and minuses of the two alternatives, something I call “prose and condos.”

The one constant is business is change. Do you know what your business is going to look like three or five years from now? By entering into a three or five year lease, you have the flexibly to adapt your space at a set point in time. Landlords can also often accommodate a tenant’s need for expansion within their portfolio at any time within a lease term.

But each time a tenant grows, shrinks or moves, they are faced with downtime in addition to relocation costs. The Landlord’s retrofit costs are ultimately passed through to the tenant, brokers need to be paid, (not necessarily a bad thing) not to mention telecom, stationery, Storage Units, marketing materials etc. For many tenants, owning a building and not moving every three to five years is an attractive alternative.

In the soft market conditions we saw from 2008 to 2012, leasing made a lot of sense. Tenants were able to save money as rental rates fell by over 25 percent in some areas. But the market is clearly rebounding, little if any now space is being developed and rates are once again heading upward. Landlords will certainly have their day again and will take every opportunity to raise their rates.

By purchasing a commercial condo, a company can fix their overhead costs over the long term. What is lost is the flexibility to expand or downsize as conditons dictate. Some condo owners hedge this risk by buying more space than they need and leasing out the rest. But this brings its own share of risk.

In a fast changing field such as technology, companies can grow or shrink rapidly. For them, it makes sense to maintain the flexibility of leasing. But for a stable law or accounting firm, a financial planner, an architect or a designer, space needs do not change significantly over time and an office condo makes sense.

If your space needs are expected to be fairly stable, owing a commercial condo offers the chance to lock in rates for the long term and avoid the substantial costs of relocation. We believe there is outstanding value in the office condo market. With properties selling at substantial discounts, these condos can be expected to appreciate in value over the next few years, which further reduces a tenant’s cost of occupancy.

This is not a simple question and there is not a simple answer. At Brenner Real Estate Group we bring the real estate expertise to assure you are getting value for your investment. It’s all part of finding the right space in the right place. (I think we’ve heard that motto before) We can put you in touch with lenders who can put together attractive financing terms. We also highly recommend that you consult with your accountant and financial planner to see how a commercial condo investment fits into your overall tax and retirement planning.