You may love our President, you may hate him, or maybe you understand both sides of the issue and hope he can still be successful. Regardless, we have a new tax law going into effect for 2018 and that law should benefit what I consider to be Florida’s number 1 industry.

Is it tourism? Well, Disney and the beaches are still huge, but no. Orange Juice? Good guess, but the last thing we need in Florida is O.J. I’ve always considered, the number one industry in Florida to be Florida itself.

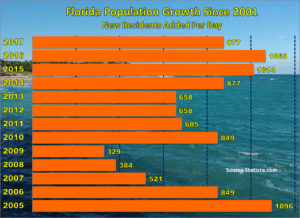

We recently passed New York as the third most populous state in the US. After some down years following the storms of 2004-5 and the great recession, Florida is back to adding approximately 1,000 residents per day. These new residents need housing, they need places to work, play and shop, they need attorneys, physicians and accountants, they need hair dressers and dog walkers and yes, even business and real estate brokers.

As long as Florida keeps adding residents, (provided we don’t destroy the environment) it’s going to be good for Florida businesses. While new residents have always been drawn to our sunshine and warm weather, you can’t ignore the impact of no State income tax. The new tax law eliminates the deduction for State income tax in New York and the 41 additional states with an income tax. This creates an additional incentive for companies and their employees to relocate to Florida. As we don’t expect Governor Scott to build a wall to keep New Yorkers out, the new tax law should further accelerate Florida’s growth. So we’re looking forward to a great year for our number one industry and for Florida business owners in general. Looking to buy or sell a business in Florida or to relocate yours? We’d be happy to help!