2021 was a year of challenges, but it turned out to be highly rewarding for the South Florida commercial real estate market and for me personally. I specialize in tenant and buyer representation in the office and industrial sector throughout the tri-county South Florida market. I work the front lines scouring the market on a daily basis to find the best space for my clients.

In my early career in market research, my perspective was based on statistical analysis. Today, the most valuable insight I can provide is a current read on what I see from a tenant perspective. Sometimes it’s useful to get a view from 30,000 feet. But it is equally important to see it from the ground up.

The two biggest factors I see influencing the current market are COVID and Amazon. COVID has accelerated technological change and fundamentally altered the way we work. Like a lot of you, I used to spend a majority of my time in an office or meeting clients. Then, circumstances suddenly demanded that we work from home. While I enjoy working from home, there are less distractions and more sharing of ideas in the office. In my opinion, and for many of my clients, a hybrid model is the optimal way to get the most accomplished.

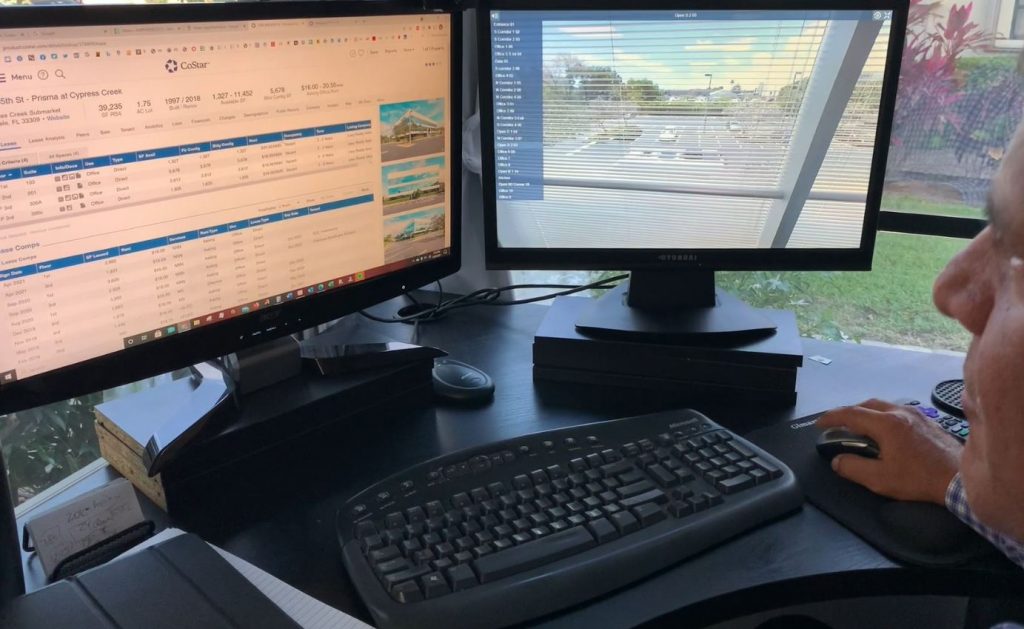

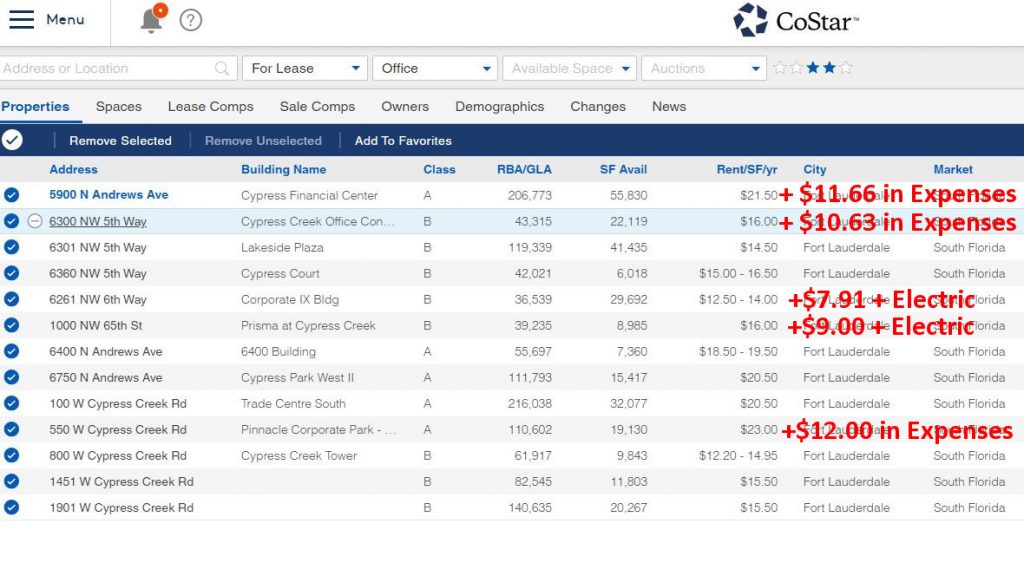

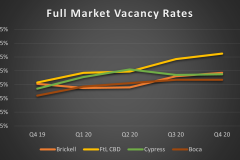

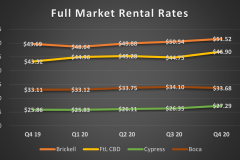

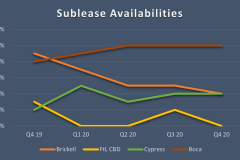

The office market has rebounded. After peaking in mid-2020, tri-county vacancies declined from 10.7 to 10.3 percent over the past 12 months (according to CoStar, the leading source of market data). Contrary to popular opinion, the office is not going away. It is changing, however. A side effect of work from home is that companies are reconsidering where they want to be geographically. South Florida is on fire as CEOs and their families continue to relocate to escape icy winters, state income tax and in some cases, restrictive shutdown policies. Meanwhile, the industrial market is booming and Amazon has added rocket fuel to that fire. My unofficial calculations show Amazon absorbing 3.5 million square feet of South Florida industrial space (including 373,000 next to a building I leased) since the onset of COVID with an additional 2 million in the pipeline. And that doesn’t account for the space occupied by Amazon resellers and its e-commerce competition.

Not surprisingly, the institutional developers are building massive warehouses to capitalize on the e-commerce boom. But this is being done at the expense of the smaller tenants in the 5,000 to 20,000 square foot range. That happens to be the market segment in which I generally operate. No one is building for small business and with limited supply, buildings that leased in the $11 to $13 (including operating expenses) pre-COVID are now in the $15 to $20 range.

And those spaces are getting harder and harder to find. My latest run on CoStar shows a 3.3 percent industrial vacancy rate in the tri-county market. But I recently ran a survey of 5,000 to 10,000 square foot availabilities in Miami’s Doral market. Of the 30 properties that came up online, only six were actually available. I see more and more brokers showing occupied spaces as available in order to generate outside activity. I identified this phenomenon on KensTrends as the “virtual property sign”. But owners, who don’t rely on outside deals, tend to be more accurate. Two of the market’s largest owner operated small-bay properties, Doral’s 3.5 million sf Miami International Commerce Center, and South Broward’s 860,000 Kelsey Business Center are showing approximately 1.5 percent available. I believe that more accurately reflects the market for 20,000 square feet of less.

So what do I see for 2022? First, if you are looking for warehouse space in South Florida, you are going to come up empty on around 80 percent of your calls. Finding warehouse space in South Florida is a needle-in-a haystack. It is very helpful to contact a tenant representation specialist who is in the market every day, knows the players and knows what is truly available. Yes, that is a plug for my own tenant representation practice.

With increasing demand for space and limited supply, industrial rental rates and property values will continue to increase. It was recently estimated that Miami will run out of industrial land in about 5 years. It will take creative solutions to continue to meet demand in South Florida and those solutions will certainly come at increased cost. Redevelopment of existing sites, adaptive re-use, higher ceilings and even multilevel warehouses are on the table. The question is whether businesses are sustainable as real estate costs continue to rise.

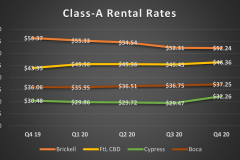

Miami’s 640,000 sf 830 Brickell is set for 2022 delievery at asking rates of up to $100 per sf. Microsoft has leased 50,000 sf.

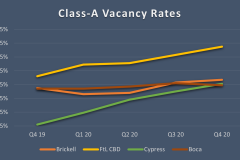

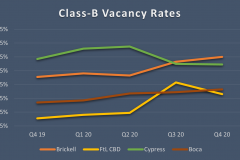

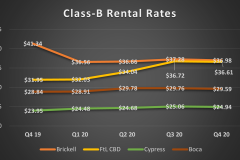

On the office side, needs are changing and many companies can operate with a portion of their workforce operating remotely. We may see some downsizing but that will occur over a three to five year cycle as leases roll over. With new office construction limited and an influx of companies relocating to South Florida, the office market is back. I don’t foresee the rapid increase in rates like we did for industrial, but nobody is giving it away. There are still pockets in the market that provide value for tenants – again it is a good idea to work with a tenant representative who is in the market every day to find the best value.

Finally, and to wrap up KensTrends for the year. I want to go back to a presentation that I sponsored back in June. While Miami has the sizzle and gets the headlines as an emerging technology hub, the entire tri-county metropolitan area of over 6 million people is benefitting. As our new Broward County Mayor Michael Udine said earlier this year “Broward (Fort Lauderdale) is getting ours”. The same holds true for Boca Raton and Palm Beach. All of South Florida is on a roll and I don’t see anything stopping it.

I’ve been active in this market for over 30 years in research, acquisitions, and leasing. I specialize in finding opportunities where others can’t. That is the result of market knowledge, experience, persistence and most importantly, communication. Please contact me if you are looking to buy, sell, lease or invest in the South Florida market.